The Daily — Gross domestic product by industry, May 2022

Released: 2022-07-29

Real GDP by industry

May 2022

0.0%

(monthly change)

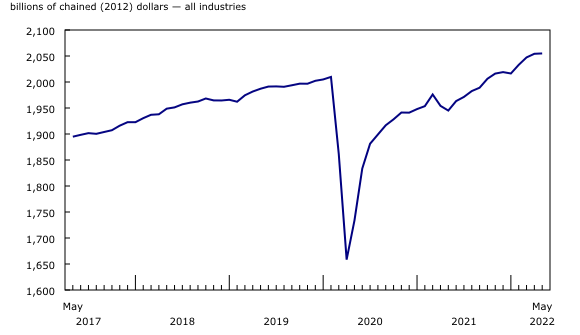

Real gross domestic product (GDP) was essentially unchanged in May, following a 0.3% expansion in April.

Growth in services-producing industries (+0.4%) was offset by a decline in goods-producing industries (-1.0%), as 14 of 20 industrial sectors increased in May.

Advance information indicates that real GDP increased 0.1% in June as output was up in the construction, manufacturing, and accommodation and food services sectors. Decreases were recorded in the mining, quarrying and oil and gas extraction sector (notably in the oil and gas extraction subsector), in the finance and insurance sector, and in the professional, scientific and technical services sector. On a quarterly basis, this advance information for real GDP by industry indicates a 1.1% increase in the second quarter of 2022. Owing to their preliminary nature, these estimates will be updated on August 31 with the release of the official GDP data for June and the second quarter of 2022.

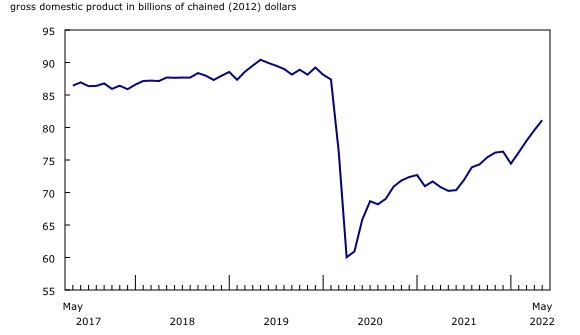

Transportation takes off

The transportation and warehousing sector rose 1.9% in May, up for the fourth month in a row. This is the first time since the series started in 1997 that the sector increased at such a rate or higher for four consecutive months. The sector was nevertheless about 7% below its February 2020 pre-COVID-19 pandemic level.

Growth was widespread with 7 of 10 subsectors expanding in May.

Chart 2

Transportation and warehousing sector grows in May

Air transportation contributed the most to the growth in the sector, rising 14.1% in May. This third consecutive double-digit monthly growth was driven by higher movements of cargo and passengers.

Urban transit systems rose 8.9% in May, following a 10.8% expansion in April. An atypical increase in ridership in May contributed to the growth of urban transit systems as many commuters continued returning to in-person work.

Rail transportation rose 2.3% in May, driven by higher rail movement of forestry products, metals and minerals and grains.

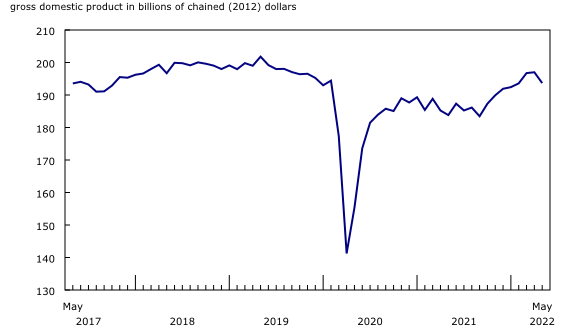

Manufacturing down for the first time in eight months

The manufacturing sector contracted 1.7% in May following seven months of growth, as both durable-goods and non-durable goods manufacturing posted declines.

Chart 3

Manufacturing sector declines in May

Durable goods manufacturing decreased 1.7% in May, its first drop since September 2021, as contractions in motor vehicle and miscellaneous manufacturing more than offset gains in 6 of 10 subsectors.

Transportation equipment manufacturing decreased 5.1% in May as reduced activity at motor vehicle (-21.2%) and motor vehicle parts (-1.2%) manufacturing contributed the most to the contraction, affected by the ongoing semi-conductor chip shortage and retooling at some assembly plants.

Non-durable goods manufacturing was down 1.7% in May, as five of nine subsectors contracted. Contributing the most to the decline were chemical manufacturing (-3.4%) and petroleum and coal products manufacturing (-3.9%). Moreover, plastics and rubber products manufacturing (-4.6%) was down partly due to lower demand from motor vehicle and motor vehicle parts manufacturers.

Construction contracts for a second consecutive month

The construction sector contracted for a second month in a row, down 1.6% in May. Many of Ontario’s unionized construction workers were on strike during the month, causing delays in numerous construction projects.

Residential building construction was down for the second consecutive month, contracting 1.9% in May. Decreases in construction of new single-family detached houses and of apartments as well as in alterations and improvements contributed the most to the decline. Nevertheless, the level of activity in May was more than 11% above the February 2020 pre-pandemic level.

Engineering and other construction activities contracted 2.0% in May, ending uninterrupted growth that began in December 2020.

Repair construction (-1.4%) declined for a second month in a row in May, as both the residential and non-residential repair activities contracted. At the same time, non-residential building construction contracted 0.4%, a first decline in six months.

Accommodation and food services up for a fourth consecutive month

The accommodation and food services sector grew 1.9% in May, up for a fourth month in a row, led in May by food services and drinking places.

Food services and drinking places rose 2.7% in May, up for the fourth month in a row, while the accommodation subsector was unchanged following three consecutive months of growth.

Wholesale rises for the first time in four months

The wholesale trade sector rose 0.7% in May, following three consecutive months of decline, led by gains concentrated in a handful of subsectors.

The food, beverage and tobacco wholesaling subsector climbed 6.5% in May, with food product wholesaling contributing the most to the growth.

Machinery, equipment and supplies wholesaling rose 1.5% in May. Driving the activity was an increase in farm, lawn and garden machinery and equipment wholesaling, reflecting higher exports of agricultural, lawn and garden machinery and equipment.

Motor vehicle and motor vehicle parts and accessories wholesaling rose 1.8%, following four consecutive months of decline.

Agriculture grows, led by crop production

Agriculture, forestry, fishing and hunting rose 1.6% in May, led by an increase in crop production. Crop production (except cannabis) rose 3.4%. Farmers’ seeding and better weather continued to provide a positive outlook for the annual harvest, aided in-part by above-average precipitation in Manitoba and Saskatchewan which helped alleviate soil moisture deficits caused by the previous year’s drought.

Mining, quarrying and oil and gas extraction edge down

Mining, quarrying and oil and gas extraction edged down 0.1% in May, following three consecutive months of growth, as a decline in oil and gas extraction more than offset gains in mining and quarrying and support activities.

Oil and gas extraction contracted for the first time in four months, down 1.4% in May. Oil sands extraction decreased 3.4% following strong growth in April. Synthetic oil contributed the most to the decline in oil sands extraction as maintenance at a number of upgrading facilities that started in April continued through May, affecting the output.

Oil and gas extraction (except oil sands) rose 1.4%, up for a fourth month in a row. Higher extraction of crude oil and natural gas contributed to the growth.

Mining and quarrying (except oil and gas) rose 1.6% in May, as a result of increases in metal ore mining (+3.0%) and non-metallic mineral mining and quarrying (+1.1%). Both benefitted from increased exports of metal ores and non-metallic minerals in May.

Support activities for mining, and oil and gas extraction increased 3.5% in May, the fourth consecutive monthly gain, as all forms of support activities were up.

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in May

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations’ transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports global sustainable development goal reporting. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry’s value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUTs) up to the latest SUT year (2018).

For the period starting in January 2019, data are derived by chaining a fixed-weight Laspeyres volume index to the prior period. The fixed weights are 2018 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

An advance estimate of industrial production for June 2022 is available upon request.

For more information on GDP, see the video “What is Gross Domestic Product (GDP)?”

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2021.

Each month, newly available administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, data confrontation and reconciliation process and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time table

Real-time table 36-10-0491-01 will be updated on August 8.

Next release

Data on GDP by industry for June will be released on August 31.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; [email protected]) or Media Relations ([email protected]).