The Daily — Monthly Survey of Manufacturing, May 2022

Released: 2022-07-14

Following seven consecutive monthly increases, manufacturing sales fell 2.0% to $71.6 billion in May, on lower sales in 11 of 21 industries. The decline was primarily driven by the motor vehicle (-31.9%), primary metal (-4.1%), and miscellaneous manufacturing (-10.8%) industries. Meanwhile, sales of petroleum and coal products (+5.4%) and machinery (+3.3%) increased the most.

Sales in constant dollars decreased 3.9% in May, indicating that lower volumes were responsible for the decline in sales on a current dollars basis, while the Industrial Product Price Index rose 1.7% in May.

Motor vehicle sales decline on plant retooling and semiconductor part shortages

Sales in the motor vehicle industry decreased 31.9% to $3.3 billion in May, following three consecutive monthly gains. The declines were attributable to retooling at auto assembly plants and semiconductor part shortages. The production of fully electric commercial vans is expected to begin in Ontario in the fourth quarter of 2022. Despite the decline in motor vehicle sales in May, year-over-year sales were up 41.3%. Exports of motor vehicles and parts declined 3.8% in May from the previous month.

Primary metal sales fell 4.1% to $6.3 billion in May, still the second highest sales level on record after April, on lower prices which led to declines in sales of alumina and aluminum products (-9.1%) and non-ferrous metals (-5.8%). Sales of primary metals in real terms edged up 0.2% in May. Prices decreased 8.1% for primary non-ferrous metals and were down 17.6% for unwrought aluminum and aluminum alloys. Prices of primary metals continue to be impacted by the global supply interruptions caused by Russia’s invasion of Ukraine.

The miscellaneous manufacturing (-10.8%), plastic and rubber product (-3.9%) and non-metallic mineral product (-6.4%) industries also contributed to the monthly decline.

The petroleum and coal industry marked a new record sales level, rising 5.4% to $10.9 billion in May, largely on higher prices. On a constant dollar basis, petroleum sales fell 1.7% in May. Prices of refined petroleum energy products (including liquid biofuels) increased 12.0% in May while exports of refined petroleum energy products were up 13.4%.

Following a 4.7% increase in April, sales of machinery reached a record high in May, rising 3.3% to $4.0 billion. Excluding the metalworking machinery industry, sales rose in all other machinery industries, led by industrial machinery (+26.2%), other general-purpose machinery (+13.0%) and ventilation, heating, air-conditioning and commercial refrigeration equipment (+9.1%). Year over year, total machinery sales increased 20.1% in May.

Sales also rose in the beverage and tobacco (+7.9%), paper (+3.6%) and computer and electronic product (+5.5%) industries in May.

Sales in Ontario decline the most on lower motor vehicle sales

Manufacturing sales decreased in five provinces in May, led by Ontario and followed by British Columbia. Meanwhile, Nova Scotia and Alberta posted the largest increases.

In Ontario, manufacturing sales fell 5.3% to $29.9 billion, primarily on lower sales of motor vehicles (-32.8%), plastic and rubber products (-6.6%) and motor vehicle parts (-4.0%). Auto production in Ontario in May was impacted by a plant shutdown, along with the global semiconductor shortages. Despite the decline in May, total Ontario sales were 22.3% higher compared with the same month a year earlier.

In British Columbia, sales decreased 1.4% to $5.8 billion in May, the second consecutive monthly decline, driven by lower sales in the primary metal, chemical, machinery and wood product industries. On a year-over-year basis, total sales for British Columbia were 3.8% higher in May.

In Nova Scotia, sales rose 13.5% in May, mainly on higher sales of seafood. The lobster fishing season in many locations in Nova Scotia started in May and sales reached the highest level on record.

Alberta sales increased 1.2% to $9.5 billion in May, the eighth consecutive month-over-month increase, largely on higher sales of the petroleum and coal (+2.7%), fabricated metals product (+5.6%) and transportation equipment (+45.8%) industries. On a year-over-year basis, total sales in Alberta rose 31.8% in May.

Toronto sales decline the most, while Québec posts the largest increase

Manufacturing sales fell in 5 of the 15 census metropolitan areas in May, led by Toronto and followed by Windsor, while sales in Québec rose the most.

Sales in Toronto decreased 3.9% to $11.5 billion in May, largely on lower sales of motor vehicles (-25.7%) and motor vehicle parts (-6.0%). With the monthly decline, motor vehicle sales reached their lowest level since June 2021. Despite the decrease, total sales on a year-over-year basis were 17.6% higher compared with May 2021.

Sales in Windsor decreased 5.7% to $1.6 billion in May, largely on lower motor vehicle and machinery sales. The declines were partially offset by higher sales in the plastic and rubber and motor vehicle part industries. The auto industry in Windsor has been facing various supply chain issues, leading to several plant shutdowns since January 2021.

Sales in Québec rose 15.1% to $2.3 billion in May, largely on higher sales in 9 of 21 industries, led by the petroleum and coal industry. Year over year, total sales in Québec were up 101.7% in May.

Record-high inventory levels continue

Total inventory levels increased 1.6% to $113.9 billion in May, mainly on higher inventories in the machinery (+4.3%), motor vehicle (+13.0%) and petroleum and coal product (+2.9%) industries. Meanwhile, inventories of the miscellaneous (-7.2%) and aerospace product and parts (-1.1%) industries fell the most in May.

Chart 2

Inventory levels rise

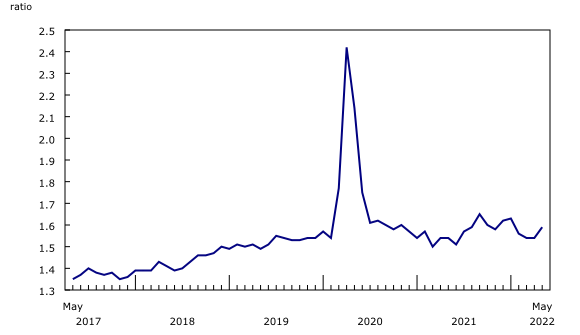

The inventory-to-sales ratio increased from 1.54 in April to 1.59 in May. This ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level.

Chart 3

The inventory-to-sales ratio increases

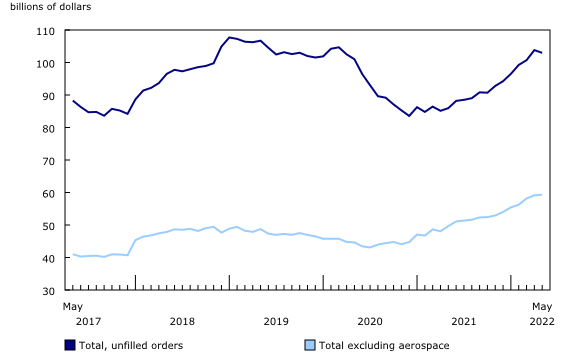

Unfilled orders slow down

Following six consecutive monthly increases, the total value of unfilled orders declined 0.8% to $103.0 billion in May, the second highest level since March 2020. The decrease was mainly attributable to lower unfilled orders in the aerospace product and parts industry (-2.3%). Total unfilled orders were up 19.8% on a year-over-year basis in May.

Chart 4

Unfilled orders decline

The total value of new orders decreased 7.1% to $70.8 billion in May, largely due to a decline in new orders in the aerospace product and parts, motor vehicles, and chemical products industries.

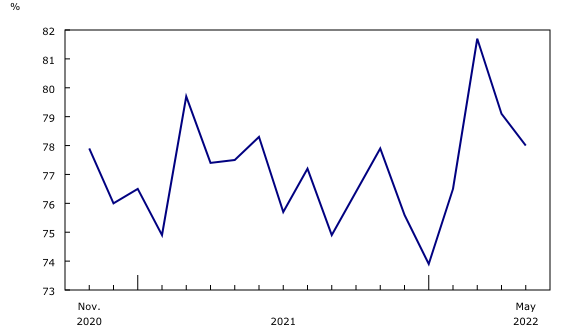

Capacity utilization rate declines on lower auto production

The capacity utilization rate (not seasonally adjusted) for the total manufacturing sector decreased from 79.1% in April to 78.0% in May due to lower production.

Chart 5

The capacity utilization rate decreases

The capacity utilization rates fell in 8 of 21 industries in May, with the largest declines seen in the transportation equipment (-12.8 percentage points), computer and electronic (-5.4 percentage points) and food (-0.5 percentage points) product industries. The declines were partially offset by a higher capacity utilization rate in the beverage and tobacco (+5.1 percentage points), machinery (+3.6 percentage points) and plastic and rubber (+3.1 percentage points) industries.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations’ transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

The Monthly Survey of Manufacturing is an example of how Statistics Canada supports the reporting on the global sustainable development goals. This release will be used to help measure the following goal:

Note to readers

Monthly data in this release are seasonally adjusted and are expressed in current dollars, unless otherwise specified.

Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Trend-cycle estimates are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the seasonally adjusted time series and provide information on longer-term movements, including changes in direction underlying the series. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions.

Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially for reference months near the end of the series or during periods of economic disruption.

Non-durable goods industries include food; beverage and tobacco products; textile mills; textile product mills; clothing; leather and allied products; paper; printing and related support activities; petroleum and coal products; chemicals; and plastics and rubber products.

Durable goods industries include wood products; non-metallic mineral products; primary metals; fabricated metal products; machinery, computer and electronic products; electrical equipment; appliances and components; transportation equipment; furniture and related products; and miscellaneous manufacturing.

Production-based industries

For the aerospace and shipbuilding industries, the value of production is used instead of the value of sales of goods manufactured. The value of production is calculated by adjusting monthly sales of goods manufactured by the monthly change in inventories of goods in process and finished products manufactured. The value of production is used because of the extended period of time that it normally takes to manufacture products in these industries.

Unfilled orders are a stock of orders that will contribute to future sales, assuming that the orders are not cancelled.

New orders are those received, whether sold in the current month or not. New orders are measured as the sum of sales for the current month plus the change in unfilled orders from the previous month to the current month.

Manufacturers reporting sales, inventories and unfilled orders in US dollars

Some Canadian manufacturers report sales, inventories and unfilled orders in US dollars. These data are then converted to Canadian dollars as part of the data production cycle.

For sales, based on the assumption that they occur throughout the month, the average monthly exchange rate for the reference month established by the Bank of Canada is used for the conversion. The monthly average exchange rate is available in table 33-10-0163-01. Inventories and unfilled orders are reported at the end of the reference period. For most respondents, the daily average exchange rate on the last working day of the month is used for the conversion of these variables.

However, some manufacturers choose to report their data as of a day other than the last working day of the month. In these instances, the daily average exchange rate on the day selected by the respondent is used. Note that because of exchange rate fluctuations, the daily average exchange rate on the day selected by the respondent can differ from both the exchange rate on the last working day of the month and the monthly average exchange rate. Daily average exchange rate data are available in table 33-10-0036-01.

Revision policy

Each month, the Monthly Survey of Manufacturing releases preliminary data for the reference month and revised data for the previous three months. Revisions are made to reflect new information provided by respondents and updates to administrative data.

Once a year, a revision project is undertaken to revise multiple years of data.

Real-time data tables

Real-time data tables 16-10-0118-01, 16-10-0119-01, 16-10-0014-01 and 16-10-0015-01 will be updated on July 21, 2022.

Next release

Data from the Monthly Survey of Manufacturing for June will be released on August 15, 2022.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; [email protected]) or Media Relations ([email protected]).